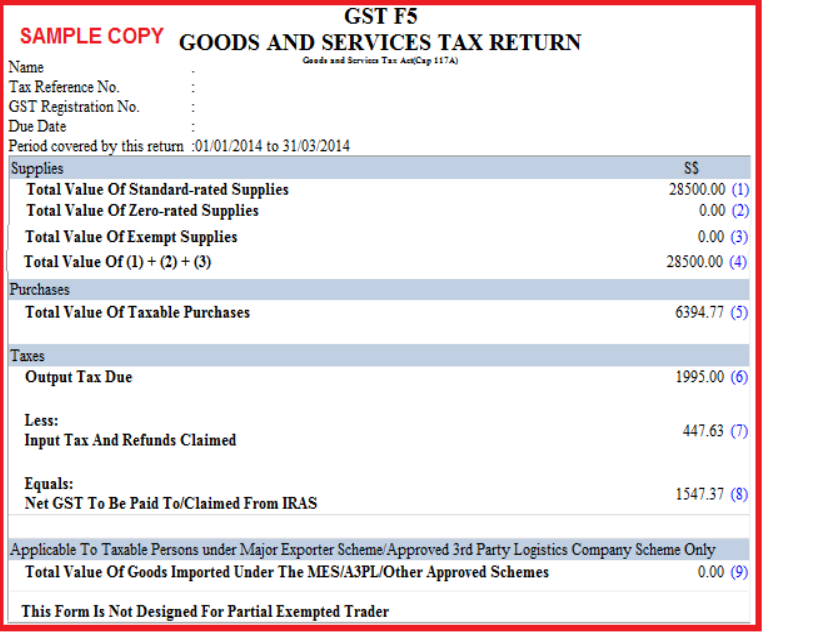

GST Form 5

Look out for Netiquette Announcement (update change of GST Tax %, if any).

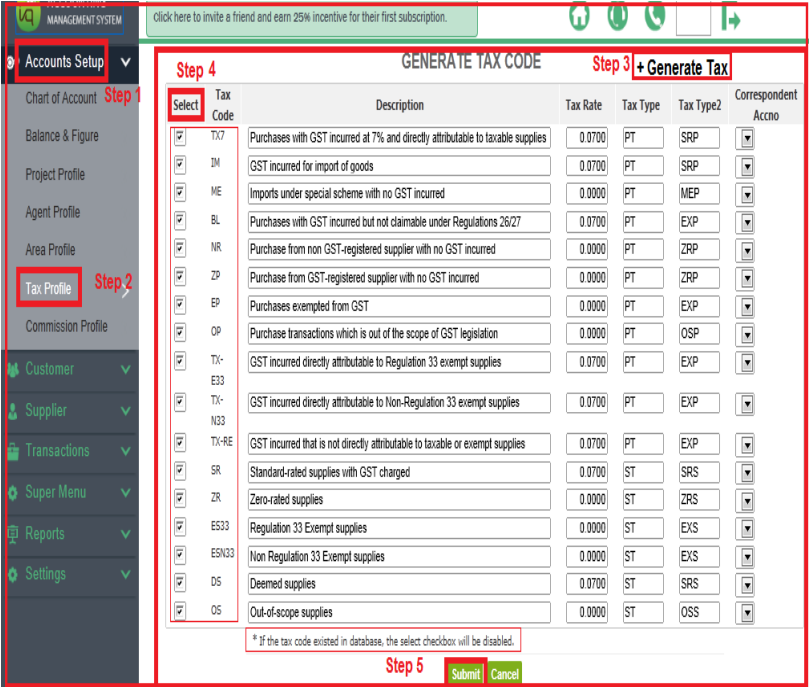

In the event of any new tax code, Netiquette will create and add on to the master list.

User is allowed to edit the tax rate but not allowed to add new tax code.

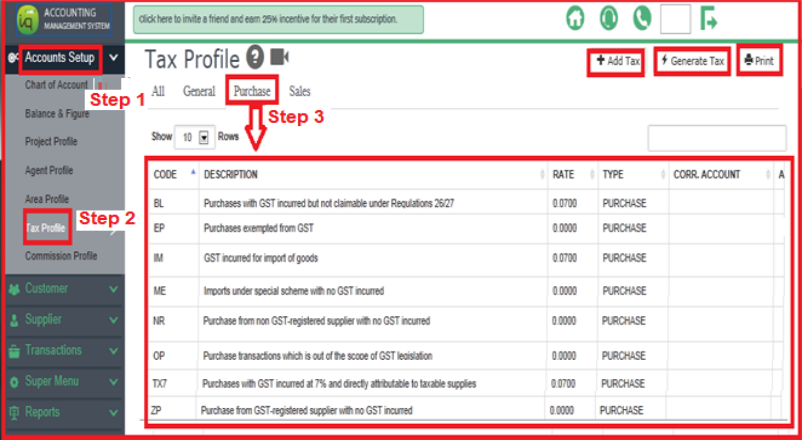

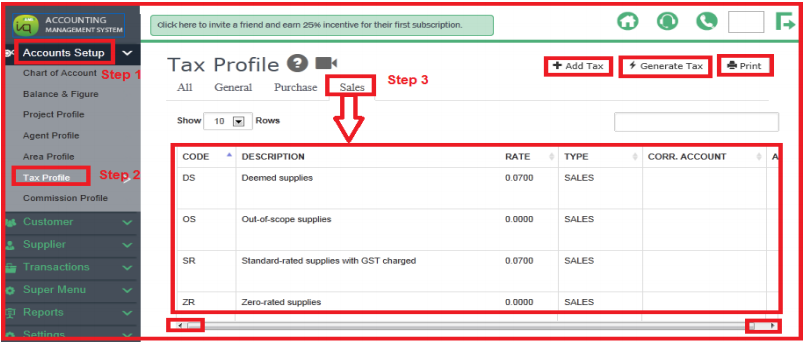

Please refer to AMS Asia Instruction Guide – Tax Profile for master list tax code.

At AMS home page, click Information Board to view Netiquette annoucement.

1) List of Purchase Tax Codes (subject to changes)

2) List of Sales Tax Codes (subject to changes)

3) List of All Tax Codes (subject to changes)

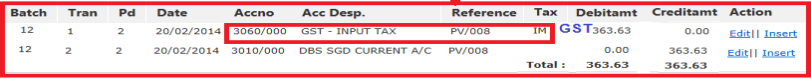

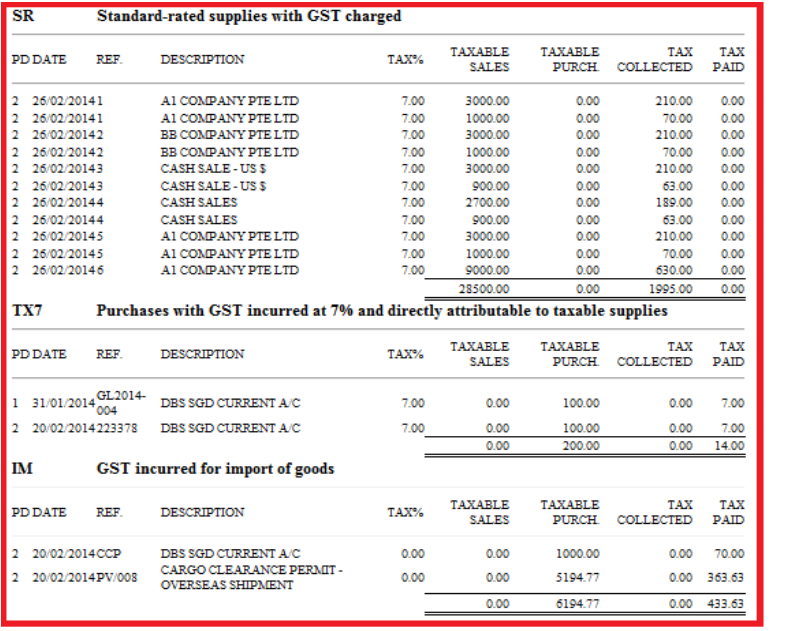

4) Posted Transactions with GST Code

Netiquette’s GST report will only capture transactions with a GST tax code to be shown on the GST Form 5.

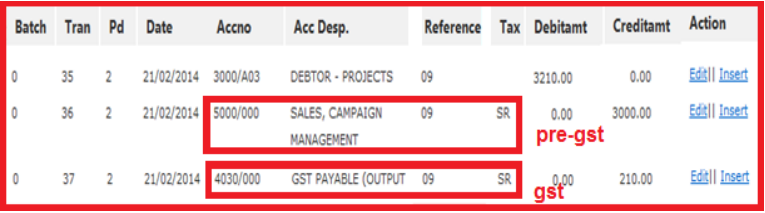

a) Posted entries of Sale Invoice (eg SR tax code

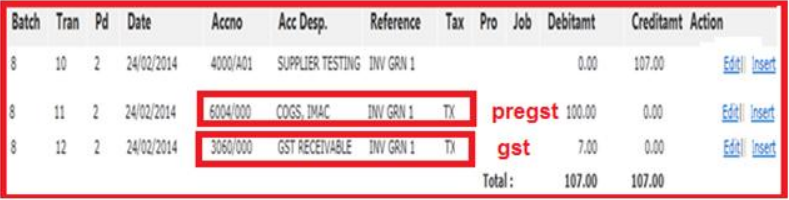

b) Posted entries of Supplier Invoice (eg TX tax code)

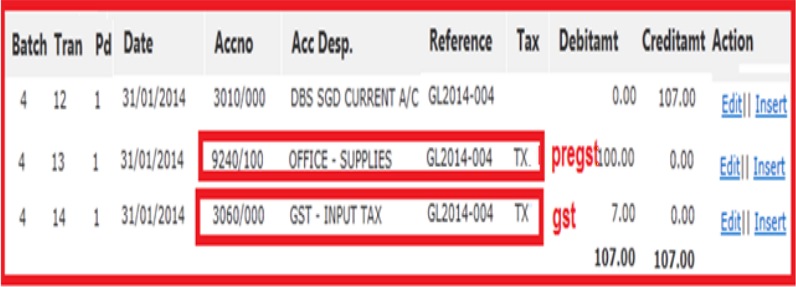

c) Posted entries of Expense Payment (eg TX tax code)

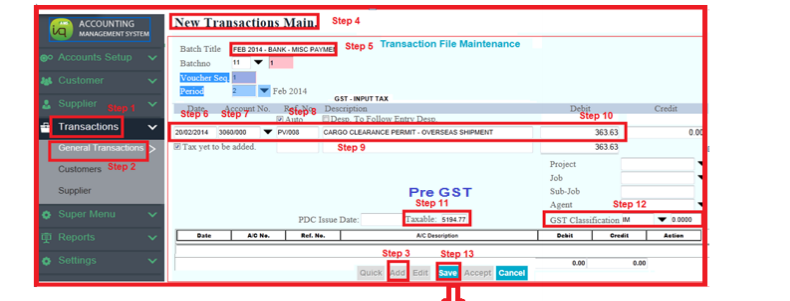

d) Posted entries of New Transaction Maintenance

At New Transaction Maintenance, user must key in pre-gst transaction follow immediately by the gst transaction.

eg taxable purchase immediately followed by IM (purchase tax code) for input tax.

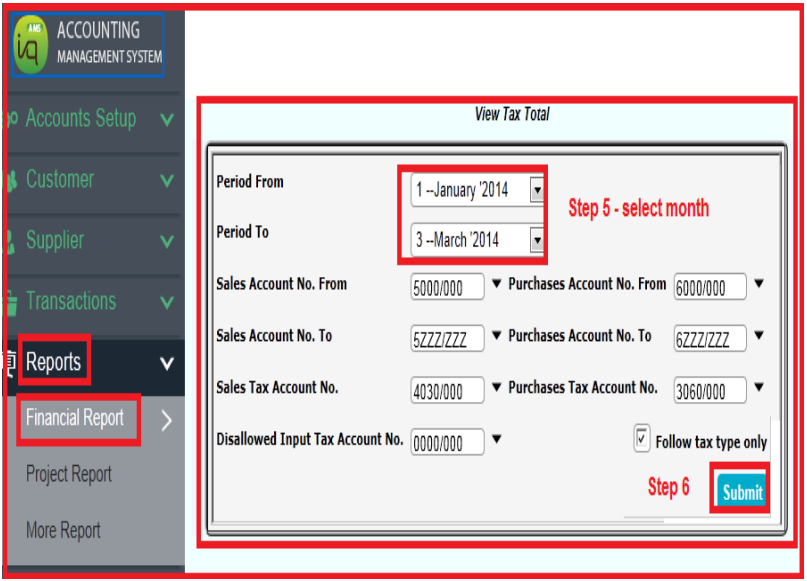

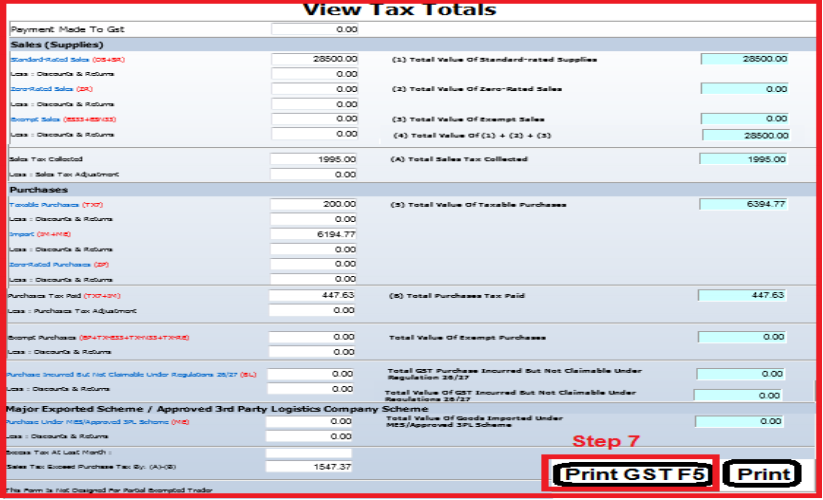

5) To print GST Form 5

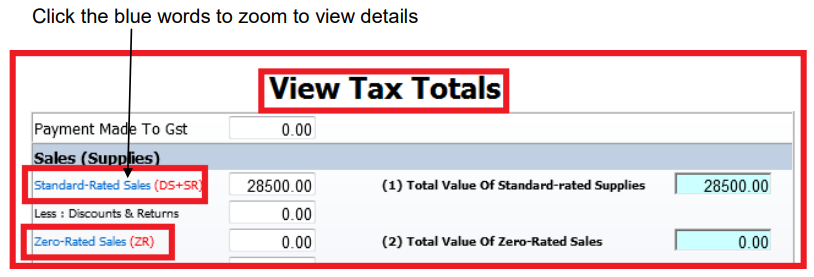

6) To view details at View Tax Totals

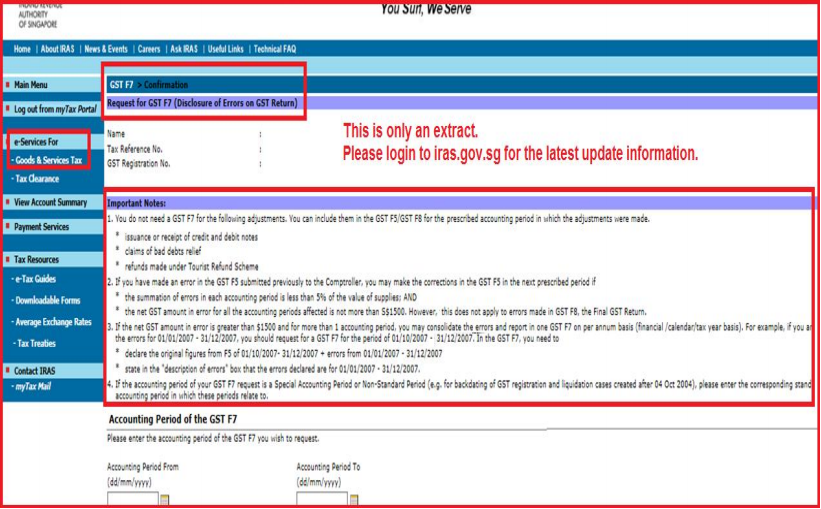

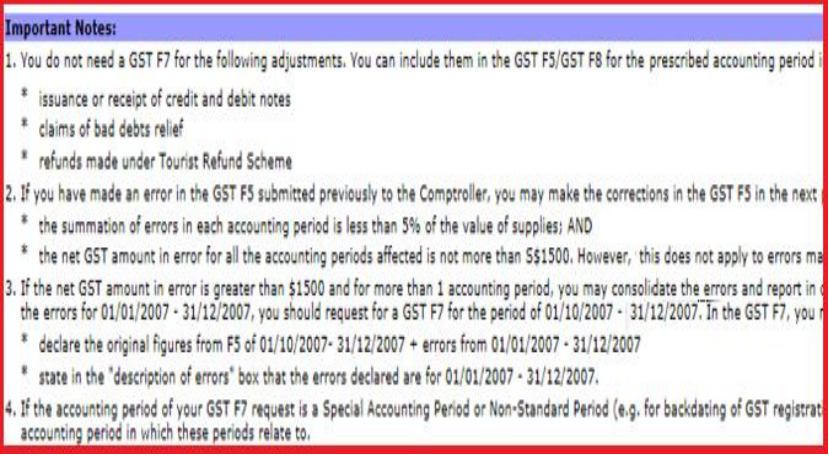

7) To amend errors in GST Form 5 (already submitted)

GST F5 – original copy already esubmitted.

Esubmitted GST F5 – amemded copy to supersede orginal copy (within time frame).

If not possible to supersede, then have to fill in GST F7 on line (follow the steps).

If not, see point 2 to bring forward the error adjustment to include in next quarter.